Lady Liberty vs. Liberation: How the U.S. Dollar Eclipses Global Markets

“It’s a dog-eat-dog world!” That is what they say, right? This phrase is usually mentioned in the midst of childish playground squabbles or maybe even during the dreadful political promotion season at work. But it is certainly not a saying you want to hear describing the current state of the global economy—and one that is becoming ever so familiar as we have officially entered two consecutive quarters of negative GDP. With a recession out of the horizon and now wading into familiar waters, countries everywhere are forced to demonstrate whether they will sink or swim. All the while, it appears the United States and the U.S. dollar have managed to cause a tidal wave for many of its counterparts.

The U.S. dollar sets the stage for global financial markets. To understand its weight, it represents half of ninety per cent of foreign exchange transactions, which accumulated up to $6 trillion of movement in one day prior to the pandemic. On September 22nd, 2022, The U.S. Dollar soared to a two-decade high record, solidifying the trend behind its increased strength. The currency, which is the world’s official reserve currency, has managed to evade devaluation in a time of economic downturn.

In a crisis, it is not uncommon for the dominating dollar to gain strength, typically attributed to its stable reliability with investors. But this large of a jump cannot be swept under the rug under the guise of dependability; there are deeper explanations and, accordingly, global implications. The Federal Reserve’s policy of combative interest rates is a primary contributor to the dollar's increased strength. The Fed has hiked up interest rates from 0.25% in March to 3.25% in October this year. Bank of America Analysts have concluded that this policy of hiked interest rates is the culprit for up to half of the dollar’s growth. Alternatively, as energy prices continue to escalate amid political tensions, a more self-reliant, resource-endowed United States has been faring much better compared to importer economies such as the Eurozone and the United Kingdom.

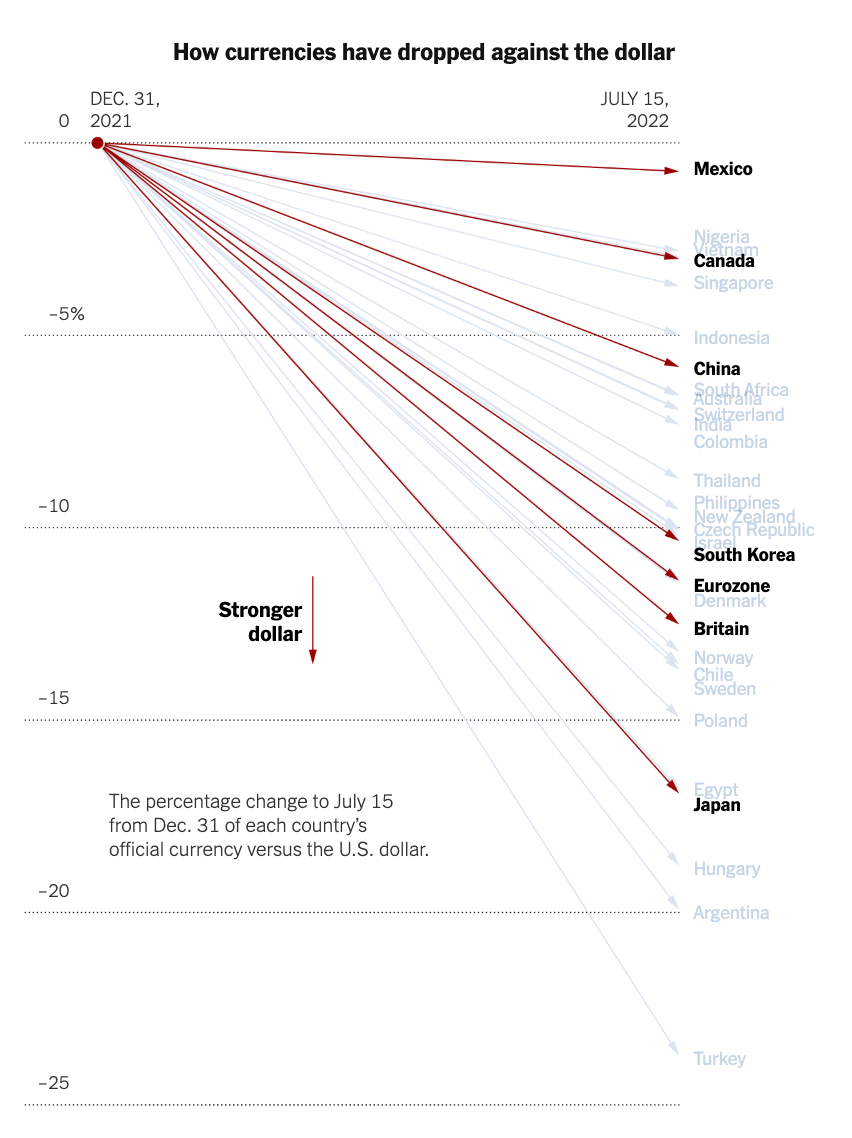

As the dollar increases, we’ve witnessed some of the globe’s strongest currencies devalue simultaneously. In parallel to the U.S., the Japanese yen experienced its lowest value in 24 years in September 2022. Their policymakers have maintained a stance against raising interest rates, leading to a decline in value of around twenty percent for the yen over the course of a year. When examining other major developed economies, such as the Eurozone, this devaluation trend persists without fail. The euro hit parity with the dollar, entering into a one-for-one exchange rate. This is the first time in twenty years that this phenomenon has occurred. But it’s not just developed economies taking a hit; currencies such as the Sri Lankan rupee, the Argentine peso, and the Hungarian forint have experienced significant downward slides in the value of their currency.

Figure 1: Change (%) from Dec 31, 2021 to July 15, 2022 of each country’s currency relative to the U.S. Dollar. Source: New York Times

Although a strong U.S. dollar can bring prosperity to many investors, firms, and local economies, such sudden stark fluctuations in currencies, specifically dominating currencies around the globe, jolts the balance of financial markets.

The fluctuation introduces a greater fiscal consequence for the masses of lower-income, developing nations. The majority of these states possess higher ratios of debt to equity. Accrued with credit, predominantly denoted in the U.S. dollar, equates to lower-capital, emerging countries forced to repay their heavy U.S. debt in much more of their devaluating local currency. In turn, overall expenditure is significantly higher than initially anticipated as interest rates climb and become progressively more challenging to return.

Sri Lanka has become an unfortunate example of this circumstance. The country defaulted on its debt in May for the first time since its independence. Faced with its worst financial crisis, Sri Lanka requested the aid of over $4 billion from the IMF. Economies met with default will be forced to undergo higher taxation, become all the more debt-reliant, or issue increased amounts of inflationary regional currency. Even with the implementation of hefty monetary policies, nations have a high chance of experiencing hyperinflation, sovereign debt crisis, or extensive recession.

As many American corporations have managed to find a safety raft amid the current financial storm, investors and creditors alike must remain prudent to the shockwaves imposed on surrounding players. In a time where political tensions have resulted in bolstered protectionism and decreased globalization, the effects of a strong dollar only contribute towards a downward trend in global trade. Nations, trade associations, and heads of state must prioritize foreign transactions and discourage barrier retaliation for the continued liberation of global markets.