Understanding the Golden Age of Private Credit

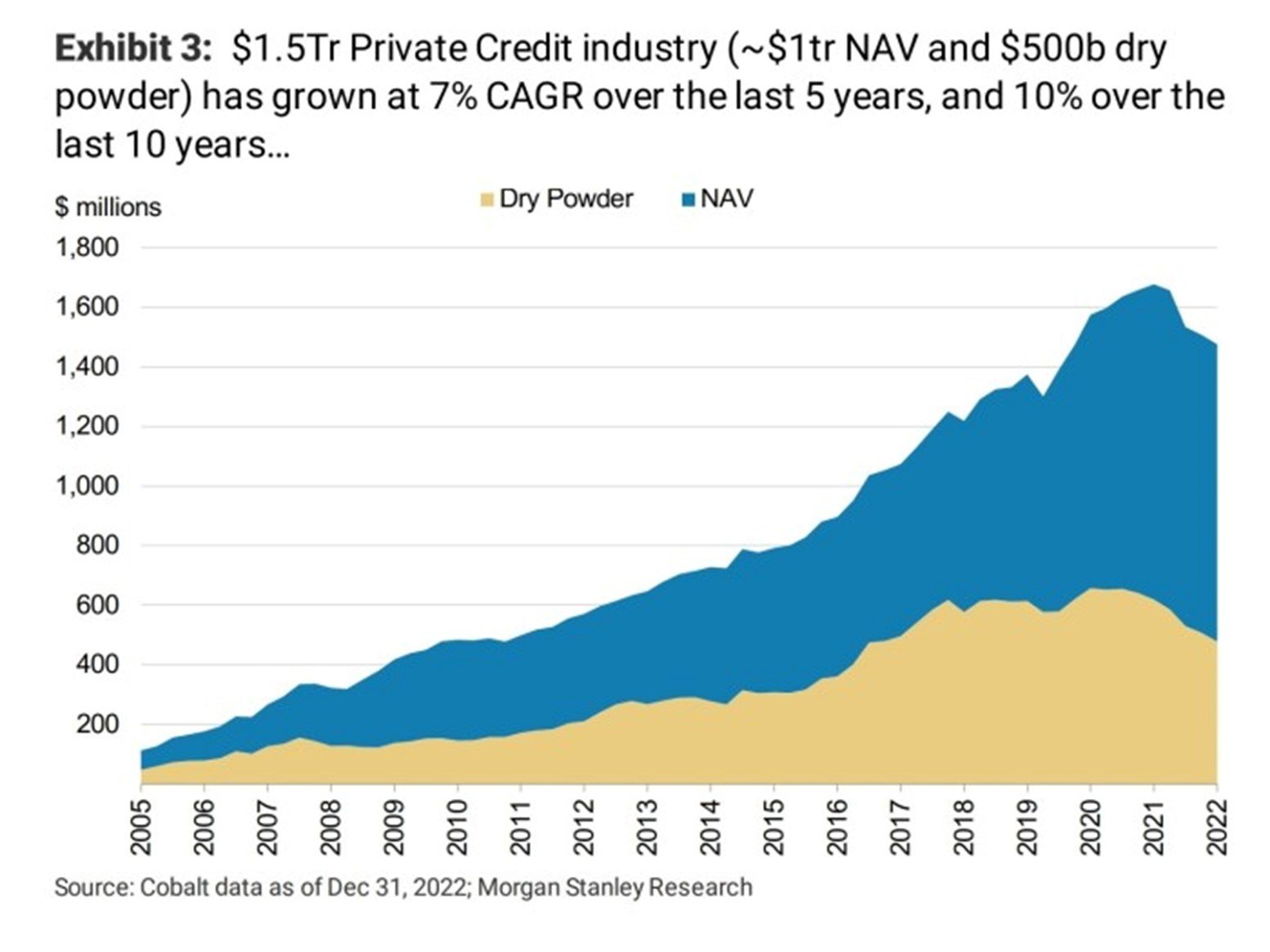

Private credit has been the emerging alternative asset class of the past 15 years, growing six-fold to US$1.5T in capital raised. The rise of private credit has been met swiftly by investors and reporters alike. With a quick Google search, there are nearly 17,000 results containing “private credit” and “golden age.” As this field of finance matures, students that are mystified by the mechanisms and jargon of traditional debt markets will need to adapt to the new learnings and opportunities that private credit introduces.

From the Bronze Age to the Golden Age

Pre-financial crisis, direct bank lending was the predominant method of debt financing for small to mid-sized companies. At this time, the private credit market was merely $100B in AUM globally, and mostly focused on financially distressed companies or special situations with nowhere else to turn for capital. Following the 2008 Financial Crisis, regulators tightened restrictions and capital requirements on public banks globally, requiring decreased lending activities in riskier debt products with low liquidity. This meant eliminating financing solutions for small to mid-sized companies that typically carry higher credit risk and which banks cannot sell other high margin products to (i.e., M&A, derivatives, pension plan management). These small to mid-sized companies are also too small to participate in the bond market, where you typically need to raise at least $200M - $500M. They also tend to be common private equity (PE) targets, and as PE funds tend to deploy a high degree of leverage, this has been another area that banks have traditionally avoided. With this financing gap to fulfill, asset managers have established private credit funds that have emerged to develop sophisticated, flexible, and strategic lending offerings across the borrowers’ capital structure.

As the private credit market has grown drastically and traditional PE-focused mega fund investors like Ares, Carlyle, Blackstone, and Bain Capital have entered, the industry is now on the verge of competing with banks to lend to large-cap companies that seek private credit’s flexibility and sophistication. To understand why asset managers are shifting into private credit and creating a “golden age” for the asset class, it is essential to understand what private credit is and the different strategies that can be employed, the capital structure, and how it provides diversification and outperformance over other asset classes.

Figures I & II: Growth of Private Credit and Private Credit Fundraising by Strategy (Financial Times)

What Is Private Credit?

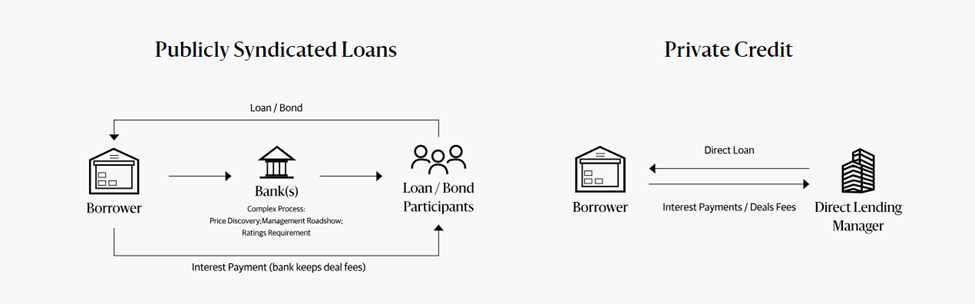

First, if you look at the familiar case of traditional public debt, it is provided by banks in the form of loans or bonds that can be traded on public markets and tends to be higher in the capital structure. Meanwhile, private credit is defined as debt financing that is typically not publicly traded, is provided by an asset manager, and has tended to be lower in the capital structure of a company. Private credit funds can take on a variety of strategies in lending, and differ based on financing size, targeted return, risk, industry, and liquidity. Two ways to break down these strategies are those focused on capital preservation, and others that are opportunistic. Capital preservation strategy funds focus on junior and senior debt to deliver predictable returns while protecting against losses. Opportunistic strategy funds invest across the credit spectrum as market opportunities permit, or in specialty finance strategies like aviation financing and health care royalties, and thereby carry higher returns associated with the higher risk of a liquidity situation.

Borrowers are enticed by private credit and are even willing to pay higher rates to go with these solutions due to flexibility, speed, sophistication, and confidentiality. Negotiations are simpler, confidential, and bilateral with one (or a few) private credit funds when private financial and operational details are needed for underwriting. This differs from publicly syndicated loans whereby borrowers must disclose this information to an entire syndicate of lenders, receive credit ratings from agencies, undertake roadshows to prospective lenders, and negotiate the pricing across the syndicate. This is important to borrowers as it increases the certainty that the loan will be executed, and the simplicity of the process as it cuts the timeline for issuance from months to weeks. This is essential to borrowers in distressed or special situations, and is why private credit has emerged as the leading financing solution for these companies. Additionally, private credit offerings from a single fund can provide more flexible loan terms and covenants in underwriting and throughout the financing lifetime over a debt syndicate. This creates a win-win situation for both borrowers and lenders by lowering the probability of default in financial distress and thereby a higher expected return for the private credit fund.

Breaking Down the Capital Structure and Debt Components

The capital structure of a company can be composed of senior debt, junior or subordinated debt, preferred equity, and common equity. With senior debt being the first to be paid out in a liquidity situation, and common equity being the last, the risk-return profile for senior debt is lower while the risk-return profile for common equity is the highest. Private credit offerings are flexible within the debt portion of the capital structure, falling between senior debt instruments and junior or subordinated credit. Within these tranches of the capital structure, debt offerings can be highly customized, with the following aspects as consideration:

Seniority: Determines payout position in a liquidity situation. A private credit fund will position itself in different seniorities depending on its risk and return profile and the borrower situation.

Interest: Interest rates can be determined based on a fixed rate or a floating rate, with floating rates using SOFR or another benchmark rate plus a fixed spread. Private credit funds tend to lean towards floating rate options to mitigate interest rate risk. Interest payments can also be structured to be cash payments or payments in kind (PIK), where the interest payment accrues to the principal of the debt – PIK tends to occur for more subordinated issuances / distressed situations.

Asset Securitization: Provides collateral for the loan against a specified asset if the borrower defaults. Securitization will also typically reduce the interest rate of the loan.

Length of Debt Issuance / Tenor: Tenor lengths tend to increase as loan seniority decreases and depend on the borrower’s financial position and capital needs.

Covenants: Covenants are restrictions to protect the investor by requiring or limiting borrower actions. Positive covenants are what the borrower must do, and include achieving certain financial ratio thresholds, financial statement provisions, and maintaining capital assets. Negative covenants preventing the borrower from undertaking certain actions, and are typically used to limit or prevent asset sales, cash dividends, other debt issuances, and M&A.

Why Private Credit is Attractive to Investors

When evaluated against traditional debt and equity asset classes, as well as alternative private equity and venture capital asset classes, private credit provides a diversification opportunity due to its high IRRs with non-correlated returns (see Figures IV & V). Private credit generates outperformance over traditional public credit due to its illiquidity premium (only tradable in underdeveloped secondary markets), its securitized nature against borrower assets that enables higher recovery values, the ability for funds to deliver operational value, and flexibility across capital structure and with covenants. Simultaneously, as private credit is subordinated to private equity and public equities, it has lower returns to these asset classes with a lower risk profile. As a result, private credit presents a valuable diversification opportunity for investors seeking higher credit-profile risks and returns.

Figure IV: Correlations of Private Credit and Other Asset Classes (Cambridge Associates)

Figure V: Underwriting Fund Target Returns for Private Credit Strategies Compared to Public Credit and Private Equity Funds

The Future of Private Credit

With the growth of private credit over the past 15 years, and the changing macroeconomic environment of today, the future of private credit will be driven by rates, international market growth, and the ability to penetrate lending solutions for large cap markets.

The high rate and inflation market from 2022 has marked the first cycle of high rates and inflation for most private credit investors. As most private credit offerings are built on floating-rate instruments, this presents a neutral trade-off in offering a higher return profile for private credit funds, while simultaneously increasing interest burdens for portfolio companies and thereby the risk of covenant breaches and defaults. Depending on the strategy of private credit funds, this high-rate environment may result in headwinds or tailwinds to returns. However, as historical lending profiles become riskier for banks in high-rate environments, this may become the opportunity for private credit to capture even more share of the lending market.

From the perspective of its investor base, private credit funds may face higher difficulty obtaining capital commitments for new funds. This is because today’s investors have higher liquidity needs in the downturn that capital markets are currently facing and may be unwilling to commit to 5 to 10 years of capital lockups.

Private credit also has substantial international growth opportunities. The U.S. market dwarfs the private credit environment, with $1.055T raised, while Europe accounts for $360.2B in private credit fundraising, and Canada only accounts for $13.7B in funds raised. While this may be driven by the different regulatory and banking environments in Canada and Europe, pressures on capital requirements for all banking jurisdictions continue to grow following the collapse of SVB and the sale of Credit Suisse to UBS.

Ultimately, as private credit enters its “golden age,” the continued growth story will be dependent on its ability to maintain better risk-adjusted returns over public credit while maintaining its flexibility and sophistication to borrowers. With today’s generation of students and talent entering capital markets in an age of exploding alternative investment asset classes, following the growth of alternative asset classes like private credit will be essential to having a holistic view of markets.